|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

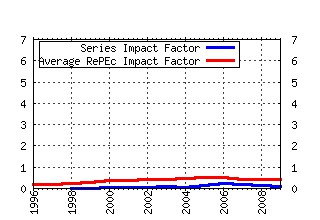

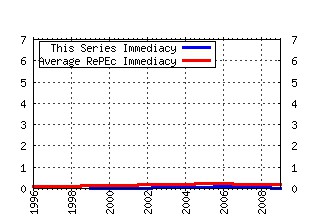

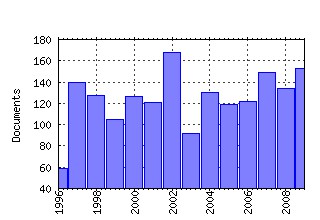

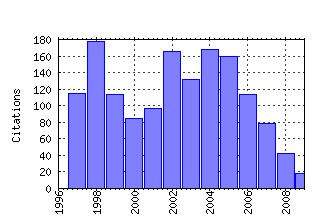

Applied Financial Economics Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:taf:apfiec:v:8:y:1998:i:6:p:689-696 Efficiency of multinational banks: an empirical investigation (1998). (2) RePEc:taf:apfiec:v:16:y:2006:i:1-2:p:1-17 Real exchange rates and Purchasing Power Parity: mean-reversion in economic thought (2006). (3) RePEc:taf:apfiec:v:8:y:1998:i:6:p:607-614 Linkages between the US and European equity markets: further evidence from cointegration tests (1998). (4) RePEc:taf:apfiec:v:15:y:2005:i:5:p:315-326 Can mergers in Europe help banks hedge against macroeconomic risk? (2005). (5) RePEc:taf:apfiec:v:12:y:2002:i:12:p:895-911 Credit risk and efficiency in the European banking system: A three-stage analysis (2002). (6) RePEc:taf:apfiec:v:8:y:1998:i:3:p:245-256 Volatility spillovers across equity markets: European evidence (1998). (7) RePEc:taf:apfiec:v:13:y:2003:i:7:p:477-486 Stock market integration and financial crises: the case of Asia (2003). (8) RePEc:taf:apfiec:v:13:y:2003:i:7:p:525-535 Monetary policy rules and regime shifts (2003). (9) RePEc:taf:apfiec:v:15:y:2005:i:14:p:1007-1017 Does patenting increase the probability of being acquired? Evidence from cross-border and domestic acquisitions (2005). (10) RePEc:taf:apfiec:v:15:y:2005:i:15:p:1041-1051 Financial development and economic growth in the Middle East (2005). (11) RePEc:taf:apfiec:v:7:y:1997:i:2:p:177-191 Regime switching in stock market returns (1997). (12) RePEc:taf:apfiec:v:7:y:1997:i:3:p:223-228 Productivity growth in the Hellenic banking industry: state versus private banks (1997). (13) RePEc:taf:apfiec:v:14:y:2004:i:1:p:55-66 Testing for inconsistencies in the estimation of UK capital structure determinants (2004). (14) RePEc:taf:apfiec:v:11:y:2001:i:1:p:1-8 Nonparametric cointegration analysis of real exchange rates (2001). (15) RePEc:taf:apfiec:v:13:y:2003:i:2:p:113-122 Technical analysis in foreign exchange markets: evidence from the EMS (2003). (16) RePEc:taf:apfiec:v:7:y:1997:i:1:p:59-74 A comparative analysis of the propagation of stock market fluctuations in alternative models of dynamic causal linkages (1997). (17) RePEc:taf:apfiec:v:7:y:1997:i:5:p:455-464 Security price anomalies in the London International Stock Exchange: a 60 year perspective (1997). (18) RePEc:taf:apfiec:v:12:y:2002:i:3:p:183-192 Does the introduction of stock index futures effectively reduce stock market volatility? Is the futures effect immediate? Evidence from the Italian stock exchange using GARCH (2002). (19) RePEc:taf:apfiec:v:14:y:2004:i:17:p:1253-1268 International portfolio diversification to Central European stock markets (2004). (20) RePEc:taf:apfiec:v:9:y:1999:i:1:p:73-85 Macroeconomic determinants of long-term stock market comovements among major EMS countries (1999). (21) RePEc:taf:apfiec:v:12:y:2002:i:1:p:19-24 The determinants of corporate debt maturity: evidence from UK firms (2002). (22) RePEc:taf:apfiec:v:10:y:2000:i:6:p:615-622 Purchasing power parity, nonlinearity and chaos (2000). (23) RePEc:taf:apfiec:v:16:y:2006:i:1-2:p:135-143 Purchasing Power Parity in economies in transition: evidence from Central and East European countries (2006). (24) RePEc:taf:apfiec:v:8:y:1998:i:6:p:577-587 Modelling real exchange rate behaviour: a cross-country study (1998). (25) RePEc:taf:apfiec:v:9:y:1999:i:5:p:501-511 Short-term and long-term price linkages between the equity markets of Australia and its major trading partners (1999). (26) RePEc:taf:apfiec:v:8:y:1998:i:2:p:167-174 Stock market prices, causality and efficiency: evidence from the Athens stock exchange (1998). (27) RePEc:taf:apfiec:v:9:y:1999:i:4:p:371-384 Efficiency and risk management in Spanish banking: a method to decompose risk (1999). (28) RePEc:taf:apfiec:v:12:y:2002:i:7:p:505-516 Competition and efficiency in the Spanish banking sector: the importance of specialization (2002). (29) RePEc:taf:apfiec:v:13:y:2003:i:9:p:693-700 Inflation and output as predictors of stock returns and volatility: international evidence (2003). (30) RePEc:taf:apfiec:v:8:y:1998:i:6:p:559-566 A fractional cointegration test of purchasing power parity: the case of selected members of OPEC (1998). (31) RePEc:taf:apfiec:v:16:y:2006:i:9:p:653-663 Economic reforms and bank efficiency in developing countries: the case of the Indian banking industry (2006). (32) RePEc:taf:apfiec:v:8:y:1998:i:4:p:377-388 Testing the conditional CAPM using multivariate GARCH-M (1998). (33) RePEc:taf:apfiec:v:15:y:2005:i:17:p:1181-1188 Modelling heavy tails and skewness in film returns (2005). (34) RePEc:taf:apfiec:v:11:y:2001:i:3:p:291-297 Positive feedback trading in emerging capital markets (2001). (35) RePEc:taf:apfiec:v:7:y:1997:i:5:p:493-498 Stock market returns in thin markets: evidence from the Vienna Stock Exchange (1997). (36) RePEc:taf:apfiec:v:14:y:2004:i:2:p:83-92 A simple test of the Fama and French model using daily data: Australian evidence (2004). (37) RePEc:taf:apfiec:v:12:y:2002:i:12:p:851-861 Testing for cointegration between international stock prices (2002). (38) RePEc:taf:apfiec:v:9:y:1999:i:2:p:173-181 Setting futures margins: the extremes approach (1999). (39) RePEc:taf:apfiec:v:9:y:1999:i:6:p:533-538 Lending rate stickiness and monetary transmission mechanism: the case of Canada and the United States (1999). (40) RePEc:taf:apfiec:v:18:y:2008:i:15:p:1201-1208 Estimating stock market volatility using asymmetric GARCH models (2008). (41) RePEc:taf:apfiec:v:14:y:2004:i:8:p:577-589 A re-examination of Wagners law for ten countries based on cointegration and error-correction modelling techniques (2004). (42) RePEc:taf:apfiec:v:16:y:2006:i:1-2:p:29-39 Testing for Purchasing Power Parity using stationary covariates (2006). (43) RePEc:taf:apfiec:v:9:y:1999:i:1:p:1-9 Short- and long-term links among European and US stock markets (1999). (44) RePEc:taf:apfiec:v:15:y:2005:i:8:p:519-530 Can the Balassa-Samuelson theory explain long-run real exchange rate movements in OECD countries? (2005). (45) RePEc:taf:apfiec:v:12:y:2002:i:7:p:475-484 African stock markets: multiple variance ratio tests of random walks (2002). (46) RePEc:taf:apfiec:v:12:y:2002:i:3:p:193-202 Forecasting volatility in the New Zealand stock market (2002). (47) RePEc:taf:apfiec:v:8:y:1998:i:5:p:541-551 Estimating structural exchange rate models by artificial neural networks (1998). (48) RePEc:taf:apfiec:v:14:y:2004:i:10:p:707-716 Downside risk for European equity markets (2004). (49) RePEc:taf:apfiec:v:7:y:1997:i:1:p:25-35 Exchange rate and stock price interactions in emerging financial markets: evidence on India, Korea, Pakistan and the Philippines (1997). (50) RePEc:taf:apfiec:v:14:y:2004:i:9:p:681-686 Efficiency of Indian commercial banks during the reform period (2004). Recent citations received in: | 2009 | 2008 | 2007 | 2006 Recent citations received in: 2009 (1) RePEc:zbw:fsfmwp:114 Staatsfonds - neue Akteure an den Finanzmärkten? (2009). Frankfurt School - Working Paper Series Recent citations received in: 2008 (1) RePEc:cns:cnscwp:200813 Clustering Mutual Funds by Return and Risk Levels (2008). Working Paper CRENoS (2) RePEc:frz:wpaper:wp2008_15.rdf Oil price Dynamics and Speculation. A Multivariate Financial Approach (2008). Working Papers Series (3) RePEc:kie:kieliw:1470 Sentiment Dynamics and Stock Returns: The Case of the German Stock Market (2008). Kiel Working Papers (4) RePEc:pra:mprapa:11535 Volatility and Long Term Relations in Equity Markets: Empirical Evidence from Germany, Switzerland, and the UK (2008). MPRA Paper (5) RePEc:pra:mprapa:12120 Bank Efficiency and Share Prices in China: Empirical Evidence from a Three-Stage Banking Model (2008). MPRA Paper (6) RePEc:zbw:cefswp:200805 Economic consequences of private equity investments on the German stock market (2008). CEFS Working Paper Series Recent citations received in: 2007 (1) RePEc:bdi:wptemi:td_615_07 Macroeconomic uncertainty and banks lending decisions: The case of Italy (2007). Temi di discussione (Economic working papers) (2) RePEc:col:000094:004246 Pronósticos directos de la inflación colombiana (2007). BORRADORES DE ECONOMIA (3) RePEc:col:000094:004247 Pronósticos directos de la inflación colombiana (2007). BORRADORES DE ECONOMIA (4) RePEc:crt:wpaper:0701 Backtesting VaR Models: An Expected Shortfall Approach (2007). Working Papers (5) RePEc:pra:mprapa:25349 Robust Tests of the Lower Partial Moment Asset Pricing Model in Emerging Markets (2007). MPRA Paper (6) RePEc:pra:mprapa:5319 Forecasting volatility: Evidence from the Macedonian stock exchange (2007). MPRA Paper (7) RePEc:taf:apfelt:v:3:y:2007:i:1:p:31-37 Simulated evidence on the distribution of the standardized one-step-ahead prediction errors in ARCH processes (2007). Applied Financial Economics Letters (8) RePEc:ven:wpaper:2007_17 Dynamic Risk Exposure in Hedge Funds (2007). Working Papers Recent citations received in: 2006 (1) RePEc:bcb:wpaper:126 Risk Premium: Insights Over The Threshold (2006). Working Papers Series (2) RePEc:crt:wpaper:0615 The Components of the Bid-Ask Spread: The case of the Athens Stock Exchange (2006). Working Papers (3) RePEc:cte:wbrepe:wb062808 RISK PREMIUM: INSIGHTS OVER THE THRESHOLD (2006). Business Economics Working Papers (4) RePEc:ega:wpaper:200607 Technology and Customer Value Dynamics in Banking Industry: Measuring Symbiotic Influence in Growth and Performance (2006). Marketing Working Papers (5) RePEc:hhs:iuiwop:0668 Producer Prices in the Transition to a Common Currency (2006). Working Paper Series (6) RePEc:ijf:ijfiec:v:11:y:2006:i:4:p:355-370 The out-of-sample forecasts of nonlinear long-memory models of the real exchange rate (2006). International Journal of Finance & Economics (7) RePEc:ivi:wpasad:2006-27 Nonlinear trend stationary of real exchange rates: The case of the Mediterranean countries (2006). Working Papers. Serie AD (8) RePEc:kap:ecopln:v:39:y:2006:i:1:p:105-124 Consolidation and Competition in Emerging Market: An Empirical Test for Malaysian Banking Industry (2006). Economic Change and Restructuring (9) RePEc:man:cgbcrp:77 Periodic Dynamic Conditional Correlations between Stock Markets in Europe and the US (2006). Centre for Growth and Business Cycle Research Discussion Paper Series (10) RePEc:sip:dpaper:06-014 Growth and Poverty Reduction Under Globalization: The Systematic Impact of Exchange Rate Misalignment (2006). Discussion Papers (11) RePEc:taf:apfelt:v:2:y:2006:i:2:p:99-103 Market trader heterogeneity and high frequency volatility dynamics: further evidence from intra-day FTSE-100 futures data (2006). Applied Financial Economics Letters (12) RePEc:uwa:wpaper:06-29 A New Approach to Forecasting Exchange Rates (2006). Economics Discussion / Working Papers (13) RePEc:zbw:sfb475:200643 Are PPP Tests Erratically Behaved? Some Panel Evidence (2006). Technical Reports Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||