|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

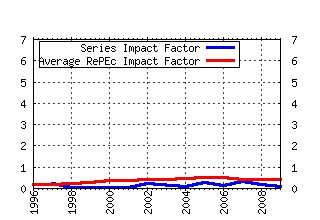

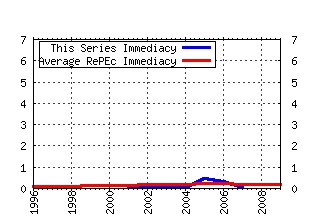

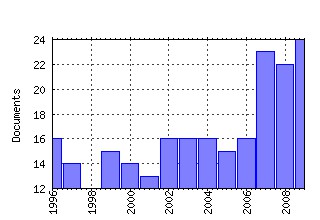

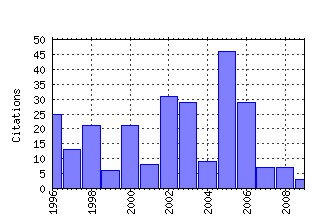

Applied Mathematical Finance Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:taf:apmtfi:v:2:y:1995:i:2:p:73-88 Pricing and hedging derivative securities in markets with uncertain volatilities (1995). (2) RePEc:taf:apmtfi:v:12:y:2005:i:4:p:313-335 Pricing in Electricity Markets: A Mean Reverting Jump Diffusion Model with Seasonality (2005). (3) RePEc:taf:apmtfi:v:7:y:2000:i:1:p:1-32 Volatility skews and extensions of the Libor market model (2000). (4) RePEc:taf:apmtfi:v:9:y:2002:i:1:p:1-20 On modelling and pricing weather derivatives (2002). (5) RePEc:taf:apmtfi:v:1:y:1994:i:2:p:111-128 Stock market bubbles in the laboratory (1994). (6) RePEc:taf:apmtfi:v:3:y:1996:i:1:p:21-52 Managing the volatility risk of portfolios of derivative securities: the Lagrangian uncertain volatility model (1996). (7) RePEc:taf:apmtfi:v:12:y:2005:i:1:p:17-52 The Dynamic Interaction of Speculation and Diversification (2005). (8) RePEc:taf:apmtfi:v:10:y:2003:i:1:p:1-18 Optimal execution with nonlinear impact functions and trading-enhanced risk (2003). (9) RePEc:taf:apmtfi:v:2:y:1995:i:3:p:155-172 Statistical modelling of asymmetric risk in asset returns (1995). (10) RePEc:taf:apmtfi:v:5:y:1998:i:3-4:p:143-163 A framework for valuing corporate securities (1998). (11) RePEc:taf:apmtfi:v:4:y:1997:i:1:p:37-64 Calibrating volatility surfaces via relative-entropy minimization (1997). (12) RePEc:taf:apmtfi:v:13:y:2006:i:1:p:39-59 A Theoretically Consistent Version of the Nelson and Siegel Class of Yield Curve Models (2006). (13) RePEc:taf:apmtfi:v:10:y:2003:i:4:p:325-336 A note on arbitrage-free pricing of forward contracts in energy markets (2003). (14) RePEc:taf:apmtfi:v:9:y:2002:i:2:p:69-85 Bivariate option pricing with copulas (2002). (15) RePEc:taf:apmtfi:v:13:y:2006:i:2:p:89-129 Interpolation Methods for Curve Construction (2006). (16) RePEc:taf:apmtfi:v:1:y:1994:i:2:p:165-194 Dynamic hedging portfolios for derivative securities in the presence of large transaction costs (1994). (17) RePEc:taf:apmtfi:v:13:y:2006:i:1:p:1-18 A Semi-Explicit Approach to Canary Swaptions in HJM One-Factor Model (2006). (18) RePEc:taf:apmtfi:v:3:y:1996:i:3:p:167-190 The use and pricing of convertible bonds (1996). (19) RePEc:taf:apmtfi:v:2:y:1995:i:3:p:173-209 Two extensions to barrier option valuation (1995). (20) RePEc:taf:apmtfi:v:14:y:2007:i:2:p:131-152 On American Options Under the Variance Gamma Process (2007). (21) RePEc:taf:apmtfi:v:15:y:2008:i:2:p:107-121 Weak Approximation of Stochastic Differential Equations and Application to Derivative Pricing (2008). (22) RePEc:taf:apmtfi:v:12:y:2005:i:1:p:53-85 Stochastic Modelling of Temperature Variations with a View Towards Weather Derivatives (2005). (23) RePEc:taf:apmtfi:v:3:y:1996:i:4:p:295-317 A systematic approach to pricing and hedging international derivatives with interest rate risk: analysis of international derivatives under stochastic interest rates (1996). (24) RePEc:taf:apmtfi:v:5:y:1998:i:1:p:45-82 General Black-Scholes models accounting for increased market volatility from hedging strategies (1998). (25) RePEc:taf:apmtfi:v:12:y:2005:i:2:p:147-185 Stochastic Volatility Model with Time-dependent Skew (2005). (26) RePEc:taf:apmtfi:v:6:y:1999:i:2:p:87-106 A finite element approach to the pricing of discrete lookbacks with stochastic volatility (1999). (27) RePEc:taf:apmtfi:v:13:y:2006:i:1:p:19-38 On the Distributional Characterization of Daily Log-Returns of a World Stock Index (2006). (28) RePEc:taf:apmtfi:v:10:y:2003:i:4:p:303-324 On arbitrage-free pricing of weather derivatives based on fractional Brownian motion (2003). (29) RePEc:taf:apmtfi:v:5:y:1998:i:1:p:1-15 Detecting mean reversion within reflecting barriers: application to the European Exchange Rate Mechanism (1998). (30) RePEc:taf:apmtfi:v:10:y:2003:i:1:p:49-74 A new approximate swaption formula in the LIBOR market model: an asymptotic expansion approach (2003). (31) RePEc:taf:apmtfi:v:2:y:1995:i:2:p:117-133 Uncertain volatility and the risk-free synthesis of derivatives (1995). (32) RePEc:taf:apmtfi:v:10:y:2003:i:1:p:19-47 Contingent claim pricing using probability distortion operators: methods from insurance risk pricing and their relationship to financial theory (2003). (33) RePEc:taf:apmtfi:v:5:y:1998:i:2:p:107-116 Optimal exercise boundary for an American put option (1998). (34) RePEc:taf:apmtfi:v:12:y:2005:i:2:p:187-199 Dynamic Principal Component Analysis of Multivariate Volatility via Fourier Analysis (2005). (35) RePEc:taf:apmtfi:v:9:y:2002:i:1:p:21-43 Energy futures prices: term structure models with Kalman filter estimation (2002). (36) RePEc:taf:apmtfi:v:11:y:2004:i:4:p:317-346 On the pricing and hedging of volatility derivatives (2004). (37) RePEc:taf:apmtfi:v:5:y:1998:i:1:p:17-43 An explicit finite difference approach to the pricing of barrier options (1998). (38) RePEc:taf:apmtfi:v:3:y:1996:i:1:p:1-20 Toward real-time pricing of complex financial derivatives (1996). (39) RePEc:taf:apmtfi:v:1:y:1994:i:1:p:21-48 Delta, gamma and bucket hedging of interest rate derivatives (1994). (40) RePEc:taf:apmtfi:v:16:y:2009:i:2:p:103-122 Modelling Electricity Prices with Forward Looking Capacity Constraints (2009). (41) RePEc:taf:apmtfi:v:2:y:1995:i:4:p:273-284 Lookback options with discrete and partial monitoring of the underlying price (1995). (42) RePEc:taf:apmtfi:v:11:y:2004:i:2:p:125-146 Modelling credit default swap spreads by means of normal mixtures and copulas (2004). (43) RePEc:taf:apmtfi:v:17:y:2010:i:6:p:471-489 Optimal Basket Liquidation for CARA Investors is Deterministic (2010). (44) RePEc:taf:apmtfi:v:4:y:1997:i:4:p:181-199 Interest rate futures: estimation of volatility parameters in an arbitrage-free framework (1997). (45) RePEc:taf:apmtfi:v:14:y:2007:i:2:p:153-169 A Non-Gaussian Ornstein-Uhlenbeck Process for Electricity Spot Price Modeling and Derivatives Pricing (2007). (46) RePEc:taf:apmtfi:v:3:y:1996:i:4:p:319-346 Binomial models for option valuation - examining and improving convergence (1996). (47) RePEc:taf:apmtfi:v:9:y:2002:i:4:p:241-260 Utility based pricing of contingent claims in incomplete markets (2002). (48) RePEc:taf:apmtfi:v:11:y:2004:i:1:p:27-50 Multiple time scales in volatility and leverage correlations: a stochastic volatility model (2004). (49) RePEc:taf:apmtfi:v:2:y:1995:i:1:p:61-72 A simple class of square-root interest-rate models (1995). (50) RePEc:taf:apmtfi:v:13:y:2006:i:3:p:265-284 Efficient Pricing of Derivatives on Assets with Discrete Dividends (2006). Recent citations received in: | 2009 | 2008 | 2007 | 2006 Recent citations received in: 2009 Recent citations received in: 2008 Recent citations received in: 2007 (1) RePEc:pra:mprapa:1952 A fast and accurate FFT-based method for pricing early-exercise options under Lévy processes (2007). MPRA Paper Recent citations received in: 2006 (1) RePEc:osk:wpaper:0626 Random Correlation Matrix and De-Noising (2006). Discussion Papers in Economics and Business (2) RePEc:pra:mprapa:1423 TIPS Options in the Jarrow-Yildirim model (2006). MPRA Paper (3) RePEc:pra:mprapa:2001 Bonds futures and their options: more than the cheapest-to-deliver; quality option and marginning (2006). MPRA Paper (4) RePEc:pra:mprapa:2249 Bonds futures: Delta? No gamma! (2006). MPRA Paper (5) RePEc:wai:econwp:06/16 A Yield Curve Perspective on Uncovered Interest Parity (2006). Working Papers in Economics Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||