|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

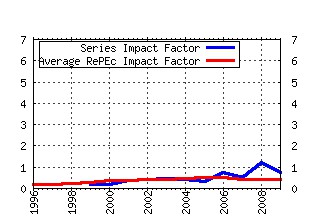

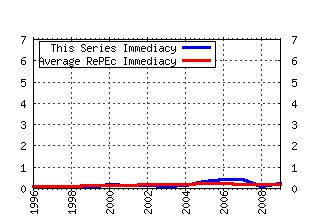

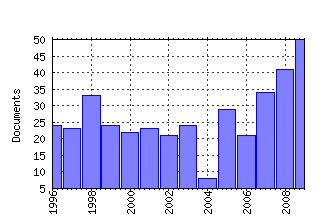

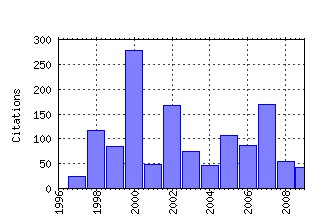

Econometric Reviews Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:taf:emetrv:v:19:y:2000:i:3:p:321-340 GMM Estimation with persistent panel data: an application to production functions (2000). (2) RePEc:taf:emetrv:v:26:y:2007:i:2-4:p:113-172 Bayesian Analysis of DSGE Models (2007). (3) RePEc:taf:emetrv:v:17:y:1998:i:1:p:57-84 A residual-based test of the null of cointegration in panel data (1998). (4) RePEc:taf:emetrv:v:21:y:2002:i:1:p:1-47 SMOOTH TRANSITION AUTOREGRESSIVE MODELS — A SURVEY OF RECENT DEVELOPMENTS (2002). (5) RePEc:taf:emetrv:v:24:y:2005:i:4:p:369-404 Evaluating Direct Multistep Forecasts (2005). (6) RePEc:taf:emetrv:v:19:y:2000:i:3:p:263-286 Nonstationary panel data analysis: an overview of some recent developments (2000). (7) RePEc:taf:emetrv:v:21:y:2002:i:4:p:431-447 ON THE ASYMPTOTICS OF ADF TESTS FOR UNIT ROOTS (2002). (8) RePEc:taf:emetrv:v:25:y:2006:i:2-3:p:145-175 Multivariate Stochastic Volatility: A Review (2006). (9) RePEc:taf:emetrv:v:21:y:2002:i:1:p:49-87 LONG-RUN STRUCTURAL MODELLING (2002). (10) RePEc:taf:emetrv:v:18:y:1999:i:1:p:119-126 Reply (1999). (11) RePEc:taf:emetrv:v:24:y:2005:i:2:p:151-173 A Parametric approach to the Estimation of Cointegration Vectors in Panel Data (2005). (12) RePEc:taf:emetrv:v:26:y:2007:i:1:p:53-90 MIDAS Regressions: Further Results and New Directions (2007). (13) RePEc:taf:emetrv:v:17:y:1998:i:1:p:1-29 Confidence intervals for impulse responses under departures from normality (1998). (14) RePEc:taf:emetrv:v:25:y:2006:i:1:p:85-116 The Performance of Panel Unit Root and Stationarity Tests: Results from a Large Scale Simulation Study (2006). (15) RePEc:taf:emetrv:v:22:y:2003:i:3:p:269-287 A Consistent Method for the Selection of Relevant Instruments (2003). (16) RePEc:taf:emetrv:v:27:y:2008:i:1-3:p:46-78 The Volatility of Realized Volatility (2008). (17) RePEc:taf:emetrv:v:22:y:2003:i:4:p:307-335 Best Spatial Two-Stage Least Squares Estimators for a Spatial Autoregressive Model with Autoregressive Disturbances (2003). (18) RePEc:taf:emetrv:v:26:y:2007:i:2-4:p:329-363 Forecast Combination and Model Averaging Using Predictive Measures (2007). (19) RePEc:taf:emetrv:v:27:y:2008:i:1-3:p:10-45 Realized Volatility: A Review (2008). (20) RePEc:taf:emetrv:v:26:y:2007:i:2-4:p:211-219 Bayesian Analysis of DSGE Models—Rejoinder (2007). (21) RePEc:taf:emetrv:v:20:y:2001:i:3:p:247-318 A REVIEW OF SYSTEMS COINTEGRATION TESTS (2001). (22) RePEc:taf:emetrv:v:23:y:2004:i:2:p:125-147 Fixed Effects and Bias Due to the Incidental Parameters Problem in the Tobit Model (2004). (23) RePEc:taf:emetrv:v:18:y:1999:i:1:p:1-73 Using simulation methods for bayesian econometric models: inference, development,and communication (1999). (24) RePEc:taf:emetrv:v:18:y:1999:i:1:p:75-87 Estimating consumer surplus comments on using simulation methods for bayesian econometric models: inference development and communication (1999). (25) RePEc:taf:emetrv:v:22:y:2003:i:2:p:135-154 Regularity of the Generalized Quadratic Production Model: A Counterexample (2003). (26) RePEc:taf:emetrv:v:23:y:2004:i:1:p:53-70 Automatic Block-Length Selection for the Dependent Bootstrap (2004). (27) RePEc:taf:emetrv:v:26:y:2007:i:6:p:609-641 Asymptotic and Bootstrap Inference for AR(∞) Processes with Conditional Heteroskedasticity (2007). (28) RePEc:taf:emetrv:v:19:y:2000:i:3:p:287-320 Stochastic dominance amongst swedish income distributions (2000). (29) RePEc:taf:emetrv:v:26:y:2007:i:2-4:p:221-252 Normalization in Econometrics (2007). (30) RePEc:taf:emetrv:v:18:y:1999:i:1:p:113-118 Using simulation methods for bayesian econometric models: inference, development and communication: some comments (1999). (31) RePEc:taf:emetrv:v:28:y:2009:i:5:p:422-440 Structure and Asymptotic Theory for Multivariate Asymmetric Conditional Volatility (2009). (32) RePEc:taf:emetrv:v:21:y:2002:i:3:p:309-336 A MONTE CARLO COMPARISON OF VARIOUS ASYMPTOTIC APPROXIMATIONS TO THE DISTRIBUTION OF INSTRUMENTAL VARIABLES ESTIMATORS (2002). (33) RePEc:taf:emetrv:v:18:y:1999:i:3:p:287-330 An introduction to hypergeometric functions for economists (1999). (34) RePEc:taf:emetrv:v:26:y:2007:i:2-4:p:289-328 Forecasting Performance of an Open Economy DSGE Model (2007). (35) RePEc:taf:emetrv:v:27:y:2008:i:1-3:p:79-111 Moving Average-Based Estimators of Integrated Variance (2008). (36) RePEc:taf:emetrv:v:28:y:2009:i:6:p:495-521 Pairwise Tests of Purchasing Power Parity (2009). (37) RePEc:taf:emetrv:v:21:y:2002:i:3:p:273-307 SEPARATION, WEAK EXOGENEITY, AND P-T DECOMPOSITION IN COINTEGRATED VAR SYSTEMS WITH COMMON FEATURES (2002). (38) RePEc:taf:emetrv:v:19:y:2000:i:3:p:341-366 Estimation of tobit-type models with individual specific effects (2000). (39) RePEc:taf:emetrv:v:23:y:2004:i:1:p:25-52 Estimator Choice and Fishers Paradox: A Monte Carlo Study (2004). (40) RePEc:taf:emetrv:v:25:y:2006:i:2-3:p:361-384 Multivariate Stochastic Volatility Models: Bayesian Estimation and Model Comparison (2006). (41) RePEc:taf:emetrv:v:19:y:2000:i:1:p:1-48 Recent developments in bootstrapping time series (2000). (42) RePEc:taf:emetrv:v:19:y:2000:i:1:p:69-103 Problems related to confidence intervals for impulse responses of autoregressive processes (2000). (43) RePEc:taf:emetrv:v:21:y:2002:i:4:p:477-496 A NONPARAMETRIC BAYESIAN APPROACH TO DETECT THE NUMBER OF REGIMES IN MARKOV SWITCHING MODELS (2002). (44) RePEc:taf:emetrv:v:27:y:2008:i:1-3:p:230-253 Sampling Returns for Realized Variance Calculations: Tick Time or Transaction Time? (2008). (45) RePEc:taf:emetrv:v:25:y:2006:i:2-3:p:335-360 Classical and Bayesian Analysis of Univariate and Multivariate Stochastic Volatility Models (2006). (46) RePEc:taf:emetrv:v:22:y:2003:i:3:p:217-237 Statistical Adequacy and the Testing of Trend Versus Difference Stationarity (2003). (47) RePEc:taf:emetrv:v:24:y:2005:i:1:p:1-37 RELIABLE INFERENCE FOR GMM ESTIMATORS? FINITE SAMPLE PROPERTIES OF ALTERNATIVE TEST PROCEDURES IN LINEAR PANEL DATA MODELS (2005). (48) RePEc:taf:emetrv:v:17:y:1998:i:4:p:339-359 Count data models with selectivity (1998). (49) RePEc:taf:emetrv:v:25:y:2006:i:4:p:523-544 Testing the Significance of Categorical Predictor Variables in Nonparametric Regression Models (2006). (50) RePEc:taf:emetrv:v:16:y:1997:i:2:p:131-156 Locally optimal one-sided tests for multiparameter hypotheses (1997). Recent citations received in: | 2009 | 2008 | 2007 | 2006 Recent citations received in: 2009 (1) RePEc:cfi:fseres:cf170 Modelling the Interactions Across International Stock, Bond and Foreign Exchange Markets (2009). CARF F-Series (2) RePEc:cfi:fseres:cf178 VaR Forecasts and Dynamic Conditional Correlations for Spot and Futures Returns on Stocks and Bonds (2009). CARF F-Series (3) RePEc:dgr:eureir:1765017295 VaR Forecast and Dynamic Conditional Correlations for Spot and Futures Returns on Stocks and Bonds (2009). Econometric Institute Report (4) RePEc:dgr:umamet:2009056 Detrending Bootstrap Unit Root Tests (2009). Research Memoranda (5) RePEc:ecb:ecbwps:20091087 Modelling Global Trade Flows - Results from a GVAR Model. (2009). Working Paper Series (6) RePEc:ijf:ijfiec:v:14:y:2009:i:1:p:45-63 Interest rate transmission in the UK: a comparative analysis across financial firms and products (2009). International Journal of Finance & Economics (7) RePEc:tky:fseres:2009cf639 Volatility Spillovers Between Crude Oil Futures Returns and Oil Company Stocks Return (2009). CIRJE F-Series (8) RePEc:tky:fseres:2009cf640 Modelling Conditional Correlations for Risk Diversification in Crude Oil Markets (2009). CIRJE F-Series (9) RePEc:tky:fseres:2009cf641 Forecasting Volatility and Spillovers in Crude Oil Spot, Forward and Futures Markets (2009). CIRJE F-Series (10) RePEc:ucm:doicae:0910 The Ten Commandments for Optimizing Value-at-Risk and Daily Capital Charges (2009). Documentos del Instituto Complutense de Análisis Económico (11) RePEc:wat:wpaper:0904 The Applications of Mixtures of Normal Distributions in Empirical Finance: A Selected Survey (2009). Working Papers Recent citations received in: 2008 (1) RePEc:par:dipeco:2008-me01 Covariance estimation via Fourier method in the presence of asynchronous trading and microstructure noise (2008). Economics Department Working Papers (2) RePEc:pra:mprapa:23721 Implied Volatility with Time-Varying Regime Probabilities (2008). MPRA Paper (3) RePEc:pra:mprapa:8692 Decimalization, Realized Volatility, and Market Microstructure Noise (2008). MPRA Paper (4) RePEc:usi:wpaper:534 Volatility forecasting: the jumps do matter (2008). Department of Economics University of Siena Recent citations received in: 2007 (1) RePEc:cpr:ceprdp:6373 Euro Area Inflation Persistence in an Estimated Nonlinear DSGE Model (2007). CEPR Discussion Papers (2) RePEc:ecl:harjfk:rwp07-057 Monetary and Fiscal Policies in a Sudden Stop: Is Tighter Brighter? (2007). Working Paper Series (3) RePEc:ecl:ucdeco:06-24 Joint Inference and Counterfactual Experimentation for Impulse Response Functions by Local Projections (2007). Working Papers (4) RePEc:ecl:ucdeco:07-7 Inference for Impulse Responses (2007). Working Papers (5) RePEc:ecl:ucdeco:07-8 Estimation and Inference by the Method of Projection Minimum Distance (2007). Working Papers (6) RePEc:hhs:oruesi:2007_013 Bayesian Forecast Combination for VAR Models (2007). Working Papers (7) RePEc:hhs:rbnkwp:0216 Bayesian forecast combination for VAR models (2007). Working Paper Series (8) RePEc:ifs:ifsewp:07/16 Heterogeneity in consumer demands and the income effect: evidence from panel data (2007). IFS Working Papers (9) RePEc:irv:wpaper:070805 Political Business Cycles in the New Keynesian Model (2007). Working Papers (10) RePEc:lvl:lacicr:0749 Mixed Exponential Power Asymmetric Conditional Heteroskedasticity (2007). Cahiers de recherche (11) RePEc:nbr:nberwo:13099 Monetary Policy Analysis with Potentially Misspecified Models (2007). NBER Working Papers (12) RePEc:pra:mprapa:3419 The U.S. Dynamic Taylor Rule With Multiple Breaks, 1984-2001. (2007). MPRA Paper (13) RePEc:rpo:ripoec:v:97:y:2007:i:6:p:149-202 Classical and Bayesian Methods for the VAR Analysis: International Comparisons (2007). Rivista di Politica Economica (14) RePEc:zbw:bubdp1:5573 Reconsidering the role of monetary indicators for euro area inflation from a Bayesian perspective using group inclusion probabilities (2007). Discussion Paper Series 1: Economic Studies Recent citations received in: 2006 (1) RePEc:hhb:hanken:0519 Bootstrap and Fast Double Bootstrap Tests of Cointegration Rank with Financial Time Series (2006). Working Papers (2) RePEc:ihs:ihsesp:197 The Carbon Kuznets Curve. A Cloudy Picture Emitted by Bad Econometrics? (2006). Economics Series (3) RePEc:msh:ebswps:2006-22 Parameterisation and Efficient MCMC Estimation of Non-Gaussian State Space Models (2006). Monash Econometrics and Business Statistics Working Papers (4) RePEc:rio:texdis:531 Realized volatility: a review (2006). Textos para discussão (5) RePEc:taf:emetrv:v:25:y:2006:i:2-3:p:425-451 Foreign Exchange Intervention by the Bank of Japan: Bayesian Analysis Using a Bivariate Stochastic Volatility Model (2006). Econometric Reviews (6) RePEc:ven:wpaper:2006_53 A generalized Dynamic Conditional Correlation Model for Portfolio Risk Evaluation (2006). Working Papers (7) RePEc:zbw:sfb475:200644 Cross-Sectional Correlation Robust Tests for Panel Cointegration (2006). Technical Reports (8) RePEc:zbw:sfb475:200646 The Error-in-Rejection Probability of Meta-Analytic Panel Tests (2006). Technical Reports (9) RePEc:zbw:sfb475:200647 For Which Countries did PPP hold? A Multiple Testing Approach (2006). Technical Reports Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||