|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

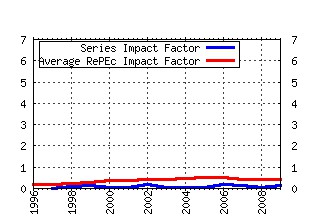

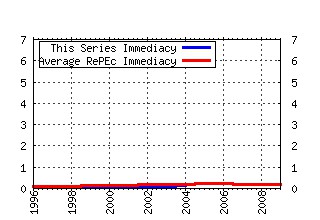

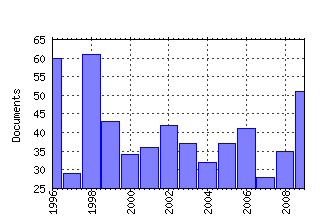

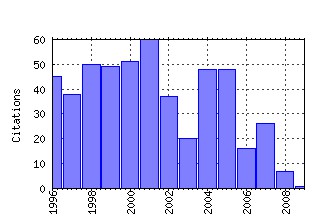

European Accounting Review Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:taf:euract:v:4:y:1995:i:2:p:261-280 The determinants of voluntary financial disclosure by Swiss listed companies (1995). (2) RePEc:taf:euract:v:6:y:1997:i:1:p:45-68 The influence of company characteristics and accounting regulation on information disclosed by Spanish firms (1997). (3) RePEc:taf:euract:v:10:y:2001:i:3:p:461-499 Agency costs and audit quality: evidence from France (2001). (4) RePEc:taf:euract:v:8:y:1999:i:2:p:351-364 A survey on the use of the Internet for investor relations in the USA, the UK and Germany (1999). (5) RePEc:taf:euract:v:8:y:1999:i:2:p:383-395 Financial information on the Internet: a survey of the homepages of Austrian companies (1999). (6) RePEc:taf:euract:v:9:y:2000:i:1:p:7-29 Environmental disclosures in the annual reports of large companies in Spain (2000). (7) RePEc:taf:euract:v:14:y:2005:i:1:p:101-126 The introduction of International Accounting Standards in Europe: Implications for international convergence (2005). (8) RePEc:taf:euract:v:8:y:1999:i:2:p:321-333 Financial reporting on the Internet by leading UK companies (1999). (9) RePEc:taf:euract:v:8:y:1999:i:2:p:373-381 The Internet as a vehicle for investor relations: the Swedish case (1999). (10) RePEc:taf:euract:v:4:y:1995:i:4:p:595-623 Accounting in transition in the transitional economy (1995). (11) RePEc:taf:euract:v:9:y:2000:i:1:p:53-79 A comparative analysis of corporate reporting on ethical issues by UK and German chemical and pharmaceutical companies (2000). (12) RePEc:taf:euract:v:7:y:1998:i:2:p:163-183 Accounting earnings and firm valuation: the French case (1998). (13) RePEc:taf:euract:v:8:y:1999:i:2:p:365-371 External reporting of accounting and financial information via the Internet in Spain (1999). (14) RePEc:taf:euract:v:11:y:2002:i:1:p:119-151 Accounting and capital markets: a survey of the European evidence (2002). (15) RePEc:taf:euract:v:14:y:2005:i:3:p:487-524 Voluntary adoption of non-local GAAP in the European Union: A study of determinants and consequences (2005). (16) RePEc:taf:euract:v:13:y:2004:i:1:p:39-71 Mobilizing local knowledge with Provocative non-financial measures (2004). (17) RePEc:taf:euract:v:14:y:2005:i:1:p:127-153 The adoption of International Accounting Standards in the European Union (2005). (18) RePEc:taf:euract:v:10:y:2001:i:4:p:679-704 The information content of earnings and turnover announcements in France (2001). (19) RePEc:taf:euract:v:5:y:1996:i:1:p:1-28 Cost accounting in Finland: current practice and trends of development (1996). (20) RePEc:taf:euract:v:3:y:1994:i:3:p:471-488 Managerial accounting in France Overview of past tradition and current practice (1994). (21) RePEc:taf:euract:v:8:y:1999:i:1:p:67-92 Comparative analysis of failure prediction methods: the Finnish case (1999). (22) RePEc:taf:euract:v:4:y:1995:i:2:p:197-215 A comparative perspective on gender and accountancy (1995). (23) RePEc:taf:euract:v:5:y:1996:i:1:p:835-844 The relationship between accounting and taxation in Norway (1996). (24) RePEc:taf:euract:v:7:y:1998:i:3:p:407-440 The development of the role of the statutory audit in the transitional Polish economy (1998). (25) RePEc:taf:euract:v:7:y:1998:i:4:p:723-751 The development of the role of the audit in the Czech Republic (1998). (26) RePEc:taf:euract:v:10:y:2001:i:1:p:51-72 Measurement of harmony of financial reporting within and between countries: the case of the Nordic countries (2001). (27) RePEc:taf:euract:v:5:y:1996:i:1:p:883-897 The relationship between accounting and taxation in Poland (1996). (28) RePEc:taf:euract:v:4:y:1995:i:4:p:625-657 A theory of European accounting development applied to accounting change in contemporary Poland (1995). (29) RePEc:taf:euract:v:14:y:2005:i:4:p:677-724 The endogeneity bias in the relation between cost-of-debt capital and corporate disclosure policy (2005). (30) RePEc:taf:euract:v:4:y:1995:i:2:p:305-322 The evolution of the Romanian and Russian accounting charts after the collapse of the communist system* (1995). (31) RePEc:taf:euract:v:12:y:2003:i:3:p:567-579 Investor relations on the Internet: a survey of the Euronext zone (2003). (32) RePEc:taf:euract:v:6:y:1997:i:1:p:19-44 Activity-based techniques and the death of the beancounter (1997). (33) RePEc:taf:euract:v:6:y:1998:i:3:p:355-375 Auditor independence, incomplete contracts and the role of legal liability (1998). (34) RePEc:taf:euract:v:13:y:2004:i:3:p:465-497 Predicting corporate failure: empirical evidence for the UK (2004). (35) RePEc:taf:euract:v:10:y:2001:i:3:p:505-522 Caught in an evaluatory trap: a dilemma for public services under NPFM (2001). (36) RePEc:taf:euract:v:13:y:2004:i:2:p:319-340 Proprietary costs and determinants of voluntary segment disclosure: evidence from Italian listed companies (2004). (37) RePEc:taf:euract:v:2:y:1993:i:2:p:219-244 The use and perceived importance of annual reports by investment analysts in the Netherlands (1993). (38) RePEc:taf:euract:v:11:y:2002:i:4:p:741-773 The impact of voluntary corporate disclosures on the ex-ante cost of capital for Swiss firms (2002). (39) RePEc:taf:euract:v:5:y:1996:i:3:p:401-411 Accounting and business economics traditions: a missing European connection? (1996). (40) RePEc:taf:euract:v:14:y:2005:i:1:p:3-39 Environmental disclosure quality in large German companies: Economic incentives, public pressures or institutional conditions? (2005). (41) RePEc:taf:euract:v:2:y:1993:i:1:p:1-16 The evolution of auditing and the independent auditor in France (1993). (42) RePEc:taf:euract:v:7:y:1998:i:1:p:105-124 The usefulness of earnings in explaining stock returns in an emerging market: the case of Cyprus (1998). (43) RePEc:taf:euract:v:14:y:2005:i:1:p:181-212 A commentary on issues relating to the enforcement of International Financial Reporting Standards in the EU (2005). (44) RePEc:taf:euract:v:6:y:1997:i:4:p:589-603 Earnings and stock returns: evidence from Germany (1997). (45) RePEc:taf:euract:v:2:y:1993:i:3:p:531-554 Lobbying behaviour and the development of international accounting standards (1993). (46) RePEc:taf:euract:v:14:y:2005:i:2:p:405-415 Nothing like the Enron affair could happen in France (!) (2005). (47) RePEc:taf:euract:v:13:y:2004:i:2:p:341-371 Accounting for financial instruments in the banking industry: conclusions from a simulation model (2004). (48) RePEc:taf:euract:v:5:y:1996:i:1:p:859-869 Relationship between accounting and taxation in the Czech Republic (1996). (49) RePEc:taf:euract:v:5:y:1996:i:2:p:243-269 Goodwill and the difference arising on first consolidation (1996). (50) RePEc:taf:euract:v:13:y:2004:i:1:p:131-159 The adjustment of financial ratios in the presence of soft budget constraints: evidence from Bulgaria (2004). Recent citations received in: | 2009 | 2008 | 2007 | 2006 Recent citations received in: 2009 Recent citations received in: 2008 Recent citations received in: 2007 Recent citations received in: 2006 Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||