|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

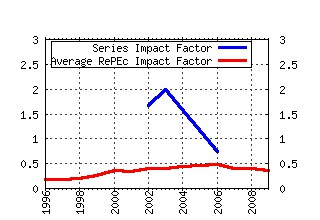

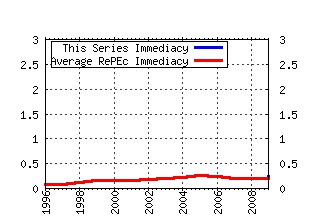

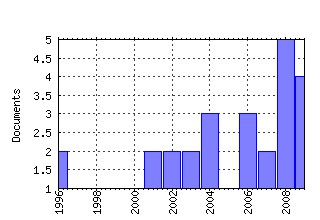

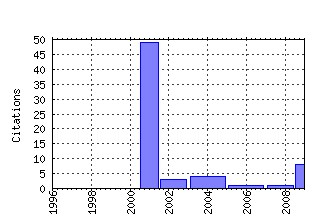

Taxation Studies Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:tax:taxstu:0005 Company Taxation in the Internal Market (2001). (2) RePEc:tax:taxstu:0028 Alternative Systems of Business Tax in Europe: An applied analysis of ACE and CBIT Reforms (2009). (3) RePEc:tax:taxstu:0012 Economic effects of tax cooperation in an enlarged European Union (2004). (4) RePEc:tax:taxstu:0031 Innovative Financing at a Global Level (2010). (5) RePEc:tax:taxstu:0008 Fiscal Measures to Reduce CO2 Emissions from New Passenger Cars (2002). (6) RePEc:tax:taxstu:0030 Effective levels of company taxation within an enlarged EU (2010). (7) RePEc:tax:taxstu:0016 Economic effects of the VAT exemption for financial and insurance services (2006). (8) RePEc:tax:taxstu:0029 Study to quantify and analyse the VAT gap in the EU-25 Member States (2009). (9) RePEc:tax:taxstu:0006 Annex to Company Taxation in the Internal Market (2001). (10) RePEc:tax:taxstu:0025 Reduced VAT for environmentally friendly products (2008). Recent citations received in: | 2009 | 2008 | 2007 | 2006 Recent citations received in: 2009 (1) RePEc:pra:mprapa:23441 Le tasse in Europa dagli anni novanta (2009). MPRA Paper Recent citations received in: 2008 Recent citations received in: 2007 Recent citations received in: 2006 Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||