|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

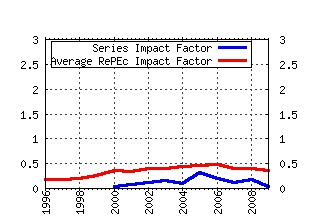

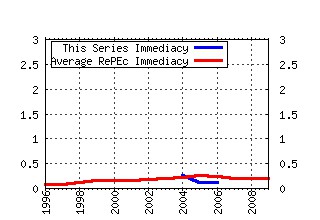

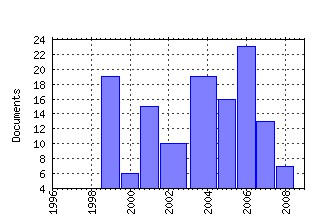

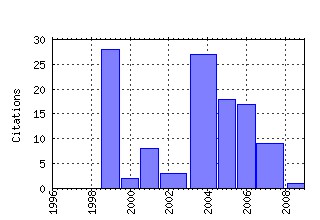

Working Papers Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:wbs:wpaper:wp99-17 Modelling Emerging Market Risk Premia Using Higher Moments (1999). (2) RePEc:wbs:wpaper:wp05-02 Time-Variation of Higher Moments in a Financial Market with Heterogeneous Agents: An Analytical Approach (2005). (3) RePEc:wbs:wpaper:wp06-18 Price Stability and Volatility in Markets with Positive and Negative Expectations Feedback: An Experimental Investigation (2006). (4) RePEc:wbs:wpaper:wp99-04 Technical Analysis and Central Bank Intervention (1999). (5) RePEc:wbs:wpaper:wp04-19 Simple Tests for Models of Dependence Between Multiple Financial Time Series, with Applications to U.S. Equity Returns and Exchange Rates (2004). (6) RePEc:wbs:wpaper:wp04-05 Properties of Optimal Forecasts under Asymmetric Loss and Nonlinearity (2004). (7) RePEc:wbs:wpaper:wp99-18 The Disappearance of Style in the US Equity Market (1999). (8) RePEc:wbs:wpaper:wp05-13 The Empirical Failure of the Expectations Hypothesis of the Term Structure of Bond Yields (2005). (9) RePEc:wbs:wpaper:wp04-16 Predictive Density Accuracy Tests (2004). (10) RePEc:wbs:wpaper:wp01-03 Investigating Dynamic Dependence Using Copulae (2001). (11) RePEc:wbs:wpaper:wp07-02 Should Network Structure Matter in Agent-Based Finance? (2007). (12) RePEc:wbs:wpaper:wp01-15 Tracking Error: Ex-Ante versus Ex-Post Measures (2001). (13) RePEc:wbs:wpaper:wp00-05 Properties of Cross-sectional Volatility (2000). (14) RePEc:wbs:wpaper:wp06-17 Dynamic instability in a phenomenological model of correlated assets (2006). (15) RePEc:wbs:wpaper:wp07-12 True and Apparent Scaling: The Proximity of the Markov- Switching Multifractal Model to Long-Range Dependence (2007). (16) RePEc:wbs:wpaper:wp99-21 How do UK-Based Foreign Exchange Dealers Think Their Market Operates? (1999). (17) RePEc:wbs:wpaper:wp04-11 Modeling and Forecasting Stock Returns: Exploiting the Futures Market, Regime Shifts and International Spillovers (2004). (18) RePEc:wbs:wpaper:wp07-08 A Prototype Model of Speculative Dynamics With Position-Based Trading (2007). (19) RePEc:wbs:wpaper:wp05-10 Incentive Contracts and Hedge Fund Management (2005). (20) RePEc:wbs:wpaper:wp06-19 The Markov-Switching Multifractal Model of Asset Returns: GMM Estimation and Linear Forecasting of Volatility (2006). (21) RePEc:wbs:wpaper:wp04-15 Properties of Bias Corrected Realized Variance Under Alternative Sampling Schemes (2004). (22) RePEc:wbs:wpaper:wp06-08 Effects of Tobin Taxes in Minority Game Markets (2006). (23) RePEc:wbs:wpaper:wp04-08 Is Seasonal Heteroscedasticity Real? An International Perspective (2004). (24) RePEc:wbs:wpaper:wp04-14 Properties of Realized Variance for a Pure Jump Process: Calendar Time Sampling versus Business Time Sampling (2004). (25) RePEc:wbs:wpaper:wp04-06 Testing and Modelling Market Microstructure Effects with an Application to the Dow Jones Industrial Average (2004). (26) RePEc:wbs:wpaper:wp99-07 An Analysis of the Performance of European Foreign Exchange Forecasters (1999). (27) RePEc:wbs:wpaper:wp02-01 Combining Heterogeneous Classifiers for Stock Selection (2002). (28) RePEc:wbs:wpaper:wp04-12 Federal Funds Rate Prediction (2004). (29) RePEc:wbs:wpaper:wp07-01 A Simple Asymmetric Herding Model to Distinguish Between Stock and Foreign Exchange Markets (2007). (30) RePEc:wbs:wpaper:wp06-15 A Behavioral Model for Participation Games with Negative Feedback (2006). (31) RePEc:wbs:wpaper:wp07-11 Rational Forecasts or Social Opinion Dynamics? Identification of Interaction Effects in a Business Climate Survey (2007). (32) RePEc:wbs:wpaper:wp05-11 Towards a Solution to the Puzzles in Exchange Rate Economics: Where Do We Stand? (2005). (33) RePEc:wbs:wpaper:wp06-21 Pricing Multivariate Currency Options with Copulas (2006). (34) RePEc:wbs:wpaper:wp04-01 Exchange Rates and Fundamentals: Evidence on the Economic Value of Predictability (2004). (35) RePEc:wbs:wpaper:wp99-03 Predictability in International Asset Returns: A Re-examination (1999). (36) RePEc:wbs:wpaper:wp06-12 Statistical mechanics of socio-economic systems with heterogeneous agents (2006). (37) RePEc:wbs:wpaper:wp01-09 Numerical Issues in Threshold Autoregressive Modelling of Time Series (2001). (38) RePEc:wbs:wpaper:wp04-10 Empirical Exchange Rate Models and Currency Risk: Some Evidence from Density Forecasts (2004). (39) RePEc:wbs:wpaper:wp02-10 Reinterpreting the Real Exchange Rate - Yield Diffential Nexus (2002). (40) RePEc:wbs:wpaper:wp99-02 Intraday Technical Trading in the Foreign Exchange Market (1999). (41) RePEc:wbs:wpaper:wp07-07 Estimation of a Microfounded Herding Model On German Survey Expectations (2007). (42) RePEc:wbs:wpaper:wp99-16 Market Risk and the Concept of Fundamental Volatility: Measuring Volatility Across Asset and Derivative Markets and Testing for the Impact of Derivatives Markets on Financial Markets (1999). (43) RePEc:wbs:wpaper:wp05-09 Employee Stock Options: Much More Valuable Than You Thought (2005). (44) RePEc:wbs:wpaper:wp02-08 Testing Mertons Model for Credit Spreads on Zero-Coupon Bonds (2002). (45) RePEc:wbs:wpaper:wp09-02 Least Squares Inference on Integrated Volatility and the Relationship between Efficient Prices and Noise (2009). (46) RePEc:wbs:wpaper:wp06-02 Price and Wealth Dynamics in a Speculative Market with Generic Procedurally Rational Traders (2006). Recent citations received in: | 2009 | 2008 | 2007 | 2006 Recent citations received in: 2009 Recent citations received in: 2008 Recent citations received in: 2007 Recent citations received in: 2006 (1) RePEc:ams:ndfwpp:06-10 A Behavioral Model for Participation Games with Negative Feedback (2006). CeNDEF Working Papers (2) RePEc:dgr:uvatin:20060073 A Behavioral Model for Participation Games with Negative Feedback (2006). Tinbergen Institute Discussion Papers (3) RePEc:nbr:nberwo:12797 Multifrequency Jump-Diffusions: An Equilibrium Approach (2006). NBER Working Papers Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||