|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

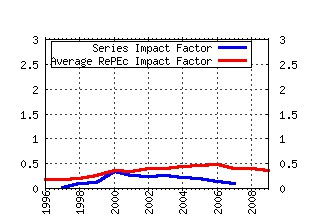

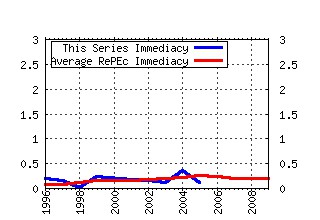

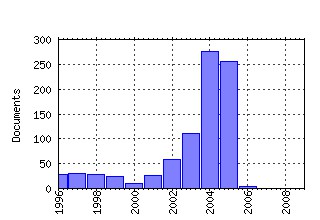

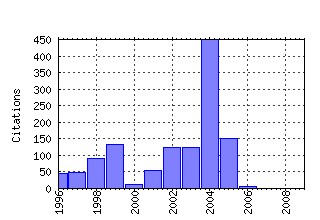

Finance Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:wpa:wuwpfi:9903005 Toeholds and Takeovers (1999). (2) RePEc:wpa:wuwpfi:0403001 Finance and the Business Cycle: International, Inter-industry Evidence (2004). (3) RePEc:wpa:wuwpfi:9808005 Is the Short Rate Drift Actually Nonlinear? (1998). (4) RePEc:wpa:wuwpfi:0404016 Further evidence on the link between finance and growth: An international analysis of community banking and economic performance (2004). (5) RePEc:wpa:wuwpfi:0404017 Further evidence on the link between finance and growth: An international analysis of community banking and economic performance (2004). (6) RePEc:wpa:wuwpfi:0207015 Asset Pricing Under The Quadratic Class (2002). (7) RePEc:wpa:wuwpfi:0111004 The Market Price of Aggregate Risk and the Wealth Distribution (2001). (8) RePEc:wpa:wuwpfi:0412002 Does Investor Misvaluation Drive the Takeover Market? (2004). (9) RePEc:wpa:wuwpfi:0412006 A Theory of Overconfidence, Self-Attribution, and Security Market Under- and Over-reactions (2004). (10) RePEc:wpa:wuwpfi:0501011 Pricing in Electricity Markets: a Mean Reverting Jump Diffusion Model with Seasonality (2005). (11) RePEc:wpa:wuwpfi:0307003 International Evidence on Financial Derivatives Usage (2003). (12) RePEc:wpa:wuwpfi:0407005 Consistent high-precision volatility from high-frequency data (2004). (13) RePEc:wpa:wuwpfi:9902005 Does Cash Flow Cause Investment and R&D: An Exploration Using Panel Data for French, Japanese, and United States Scientific Firms (1999). (14) RePEc:wpa:wuwpfi:0312001 Consensus consumer and intertemporal asset pricing with heterogeneous beliefs (2003). (15) RePEc:wpa:wuwpfi:0207008 Accouting for Biases in Black-Scholes (2002). (16) RePEc:wpa:wuwpfi:0210005 Herding and Contrarian Behavior in Financial Markets - An Internet Experiment (2002). (17) RePEc:wpa:wuwpfi:0207014 Design and Estimation of Quadratic Term Structure Models (2002). (18) RePEc:wpa:wuwpfi:0404023 Initiative, Incentives and Soft Information. How Does Delegation Impact The Role of Bank Relationship Managers? (2004). (19) RePEc:wpa:wuwpfi:9803001 Volume, Volatility, Price and Profit When All Traders Are Above Average (1998). (20) RePEc:wpa:wuwpfi:9712007 Estimation of Time-Varying Hedge Ratios for Corn and Soybeans: BGARCH and Random Coefficient Approaches (1997). (21) RePEc:wpa:wuwpfi:9904004 When are Options Overpriced? The Black-Scholes Model and Alternative Characterisations of the Pricing Kernel. (1999). (22) RePEc:wpa:wuwpfi:9803002 Recovering Risk Aversion from Option Prices and Realized Returns (1998). (23) RePEc:wpa:wuwpfi:0412001 Do Investors Overvalue Firms With Bloated Balance Sheets? (2004). (24) RePEc:wpa:wuwpfi:0207011 Time-Changed Levy Processes and Option Pricing (2002). (25) RePEc:wpa:wuwpfi:0411007 Fractional calculus and continuous-time finance (2004). (26) RePEc:wpa:wuwpfi:0501003 Do Ads Influence Editors? Advertising and Bias in the Financial Media (2005). (27) RePEc:wpa:wuwpfi:0404021 Investor protection and business creation (2004). (28) RePEc:wpa:wuwpfi:0411008 Fractional calculus and continuous-time finance II: the waiting- time distribution (2004). (29) RePEc:wpa:wuwpfi:9810003 Housing Market Fluctuations in a Life-Cycle Economy with Credit Constraints (1998). (30) RePEc:wpa:wuwpfi:9711004 Market Efficiency and Marketing to Enhance Income of Crop Producers (1997). (31) RePEc:wpa:wuwpfi:0201003 Stealth-Trading: Which Traders Trades Move Stock Prices? (2002). (32) RePEc:wpa:wuwpfi:0409015 Variance Risk Premia (2004). (33) RePEc:wpa:wuwpfi:9610002 Trading Frequency and Event Study Test Specification (1996). (34) RePEc:wpa:wuwpfi:0412004 Good Day Sunshine: Stock Returns and the Weather (2004). (35) RePEc:wpa:wuwpfi:0504008 Econometric Tests of Asset Price Bubbles: Taking Stock (2005). (36) RePEc:wpa:wuwpfi:0411049 Information Reusability, Competition and Bank Asset Quality (2004). (37) RePEc:wpa:wuwpfi:0411018 Is Fairly Priced Deposit Insurance Possible? (2004). (38) RePEc:wpa:wuwpfi:0412005 Can Individual Investors Beat the Market? (2004). (39) RePEc:wpa:wuwpfi:0411015 Market Indicators, Bank Fragility, and Indirect Market Discipline (2004). (40) RePEc:wpa:wuwpfi:0310009 Explicit bond option and swaption formula in Heath-Jarrow-Morton one factor model (2003). (41) RePEc:wpa:wuwpfi:0112003 An Empirical Comparison of Default Swap Pricing Models (2001). (42) RePEc:wpa:wuwpfi:9902009 Innovation and Market Value (1999). (43) RePEc:wpa:wuwpfi:0405003 Simulation-based stress testing of banks regulatory capital adequacy (2004). (44) RePEc:wpa:wuwpfi:0310004 COMPETITION AND CONTESTABILITY IN CENTRAL AND EASTERN EUROPEAN BANKING MARKETS (2003). (45) RePEc:wpa:wuwpfi:0401002 Specification Analysis of Option Pricing Models Based on Time- Changed Levy Processes (2004). (46) RePEc:wpa:wuwpfi:0210006 Why do European Venture Capital Companies syndicate? (2002). (47) RePEc:wpa:wuwpfi:0411051 Competition, Risk Neutrality and Loan Commitments (2004). (48) RePEc:wpa:wuwpfi:0512006 Expectations, Bond Yields and Monetary Policy (2005). (49) RePEc:wpa:wuwpfi:0207017 Time-Varying Arrival Rates of Informed and Uninformed Trades (2002). (50) RePEc:wpa:wuwpfi:9608001 Toeholds and Takeovers (1996). Recent citations received in: | 2009 | 2008 | 2007 | 2006 Recent citations received in: 2009 Recent citations received in: 2008 Recent citations received in: 2007 Recent citations received in: 2006 Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||