|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

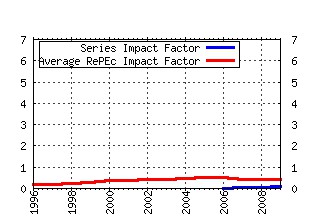

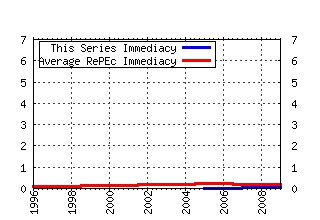

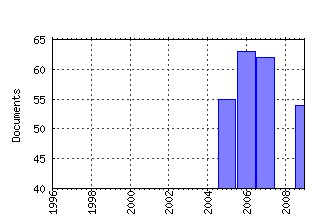

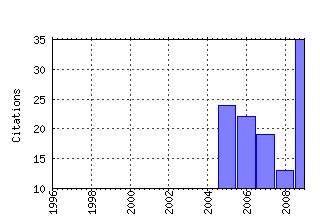

International Journal of Theoretical and Applied Finance (IJTAF) Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:wsi:ijtafx:v:12:y:2009:i:07:p:1007-1026 COUNTERPARTY RISK FOR CREDIT DEFAULT SWAPS: IMPACT OF SPREAD VOLATILITY AND DEFAULT CORRELATION (2009). (2) RePEc:wsi:ijtafx:v:12:y:2009:i:06:p:861-876 SMALL-TIME ASYMPTOTICS FOR IMPLIED VOLATILITY UNDER THE HESTON MODEL (2009). (3) RePEc:wsi:ijtafx:v:08:y:2005:i:05:p:537-551 VALUE-AT-RISK AND EXPECTED SHORTFALL FOR LINEAR PORTFOLIOS WITH ELLIPTICALLY DISTRIBUTED RISK FACTORS (2005). (4) RePEc:wsi:ijtafx:v:08:y:2005:i:07:p:839-869 A GENERAL EQUILIBRIUM MODEL OF THE TERM STRUCTURE OF INTEREST RATES UNDER REGIME-SWITCHING RISK (2005). (5) RePEc:wsi:ijtafx:v:09:y:2006:i:01:p:23-42 THE DETERMINANTS OF CREDIT DEFAULT SWAP RATES: AN EXPLANATORY STUDY (2006). (6) RePEc:wsi:ijtafx:v:09:y:2006:i:02:p:185-197 PRICING DERIVATIVES ON TWO-DIMENSIONAL LÃVY PROCESSES (2006). (7) RePEc:wsi:ijtafx:v:10:y:2007:i:04:p:733-748 JOINT DISTRIBUTIONS OF PORTFOLIO LOSSES AND EXOTIC PORTFOLIO PRODUCTS (2007). (8) RePEc:wsi:ijtafx:v:12:y:2009:i:04:p:427-441 ON THE RELATIONSHIP BETWEEN THE CALL PRICE SURFACE AND THE IMPLIED VOLATILITY SURFACE CLOSE TO EXPIRY (2009). (9) RePEc:wsi:ijtafx:v:14:y:2011:i:01:p:137-162 COMPOSITION OF TIME-CONSISTENT DYNAMIC MONETARY RISK MEASURES IN DISCRETE TIME (2011). (10) RePEc:wsi:ijtafx:v:10:y:2007:i:03:p:517-534 HEDGING VOLATILITY RISK: THE EFFECTIVENESS OF VOLATILITY OPTIONS (2007). (11) RePEc:wsi:ijtafx:v:09:y:2006:i:04:p:455-481 MONTE CARLO EVALUATION OF AMERICAN OPTIONS USING CONSUMPTION PROCESSES (2006). (12) RePEc:wsi:ijtafx:v:13:y:2010:i:01:p:1-43 EFFICIENT, ALMOST EXACT SIMULATION OF THE HESTON STOCHASTIC VOLATILITY MODEL (2010). (13) RePEc:wsi:ijtafx:v:08:y:2005:i:06:p:807-838 PARTIAL INFORMATION AND HAZARD PROCESS (2005). (14) RePEc:wsi:ijtafx:v:11:y:2008:i:01:p:87-106 A SHOT NOISE MODEL FOR FINANCIAL ASSETS (2008). (15) RePEc:wsi:ijtafx:v:08:y:2005:i:03:p:301-319 OPTIMAL LOGARITHMIC UTILITY AND OPTIMAL PORTFOLIOS FOR AN INSIDER IN A STOCHASTIC VOLATILITY MARKET (2005). (16) RePEc:wsi:ijtafx:v:12:y:2009:i:08:p:1213-1230 CREDIT RISK MODELING USING TIME-CHANGED BROWNIAN MOTION (2009). (17) RePEc:wsi:ijtafx:v:12:y:2009:i:01:p:45-62 A DYNAMIC APPROACH TO THE MODELING OF CORRELATION CREDIT DERIVATIVES USING MARKOV CHAINS (2009). (18) RePEc:wsi:ijtafx:v:10:y:2007:i:04:p:633-652 STOCHASTIC INTENSITY MODELING FOR STRUCTURED CREDIT EXOTICS (2007). (19) RePEc:wsi:ijtafx:v:13:y:2010:i:06:p:821-838 AN ANALYSIS OF THE SUPPLY CURVE FOR LIQUIDITY RISK THROUGH BOOK DATA (2010). (20) RePEc:wsi:ijtafx:v:14:y:2011:i:06:p:773-802 ARBITRAGE-FREE VALUATION OF BILATERAL COUNTERPARTY RISK FOR INTEREST-RATE PRODUCTS: IMPACT OF VOLATILITIES AND CORRELATIONS (2011). (21) RePEc:wsi:ijtafx:v:10:y:2007:i:02:p:273-306 ON ERRORS AND BIAS OF FOURIER TRANSFORM METHODS IN QUADRATIC TERM STRUCTURE MODELS (2007). (22) RePEc:wsi:ijtafx:v:09:y:2006:i:06:p:915-949 PRICING OF FIRST TOUCH DIGITALS UNDER NORMAL INVERSE GAUSSIAN PROCESSES (2006). (23) RePEc:wsi:ijtafx:v:08:y:2005:i:02:p:161-184 AFFINE PROCESSES, ARBITRAGE-FREE TERM STRUCTURES OF LEGENDRE POLYNOMIALS, AND OPTION PRICING (2005). (24) RePEc:wsi:ijtafx:v:10:y:2007:i:04:p:607-631 CLUSTER-BASED EXTENSION OF THE GENERALIZED POISSON LOSS DYNAMICS AND CONSISTENCY WITH SINGLE NAMES (2007). (25) RePEc:wsi:ijtafx:v:08:y:2005:i:07:p:933-946 EXPERTS EARNING FORECASTS: BIAS, HERDING AND GOSSAMER INFORMATION (2005). (26) RePEc:wsi:ijtafx:v:11:y:2008:i:03:p:325-343 EQUILIBRIUM PRICES FOR MONETARY UTILITY FUNCTIONS (2008). (27) RePEc:wsi:ijtafx:v:10:y:2007:i:07:p:1203-1227 CALCULATING THE EARLY EXERCISE BOUNDARY OF AMERICAN PUT OPTIONS WITH AN APPROXIMATION FORMULA (2007). (28) RePEc:wsi:ijtafx:v:11:y:2008:i:06:p:611-634 PRICING AND HEDGING OF PORTFOLIO CREDIT DERIVATIVES WITH INTERACTING DEFAULT INTENSITIES (2008). (29) RePEc:wsi:ijtafx:v:09:y:2006:i:06:p:825-841 OPTION PRICING FOR GARCH MODELS WITH MARKOV SWITCHING (2006). (30) RePEc:wsi:ijtafx:v:08:y:2005:i:01:p:1-12 BAYESIAN INFERENCE, PRIOR INFORMATION ON VOLATILITY, AND OPTION PRICING: A MAXIMUM ENTROPY APPROACH (2005). (31) RePEc:wsi:ijtafx:v:13:y:2010:i:03:p:415-440 A GENERALIZED NORMAL MEAN-VARIANCE MIXTURE FOR RETURN PROCESSES IN FINANCE (2010). (32) RePEc:wsi:ijtafx:v:11:y:2008:i:02:p:163-197 A NEW FRAMEWORK FOR DYNAMIC CREDIT PORTFOLIO LOSS MODELLING (2008). (33) RePEc:wsi:ijtafx:v:14:y:2011:i:04:p:433-463 MODEL-FREE IMPLIED VOLATILITY: FROM SURFACE TO INDEX (2011). (34) RePEc:wsi:ijtafx:v:12:y:2009:i:02:p:179-207 PRICING FOR GEOMETRIC MARKED POINT PROCESSES UNDER PARTIAL INFORMATION: ENTROPY APPROACH (2009). (35) RePEc:wsi:ijtafx:v:10:y:2007:i:01:p:51-88 PRICING PATH-DEPENDENT OPTIONS ON STATE DEPENDENT VOLATILITY MODELS WITH A BESSEL BRIDGE (2007). (36) RePEc:wsi:ijtafx:v:12:y:2009:i:07:p:949-967 PRICING AND HEDGING IN CARBON EMISSIONS MARKETS (2009). (37) RePEc:wsi:ijtafx:v:08:y:2005:i:03:p:381-392 LONG MEMORY STOCHASTIC VOLATILITY IN OPTION PRICING (2005). (38) RePEc:wsi:ijtafx:v:10:y:2007:i:06:p:985-1014 UNCERTAINTY AVERSION, ROBUST CONTROL AND ASSET HOLDINGS WITH A STOCHASTIC INVESTMENT OPPORTUNITY SET (2007). (39) RePEc:wsi:ijtafx:v:13:y:2010:i:08:p:1149-1177 MARKETS AS A COUNTERPARTY: AN INTRODUCTION TO CONIC FINANCE (2010). (40) RePEc:wsi:ijtafx:v:11:y:2008:i:05:p:503-528 MULTI-FACTOR JUMP-DIFFUSION MODELS OF ELECTRICITY PRICES (2008). (41) RePEc:wsi:ijtafx:v:09:y:2006:i:05:p:643-671 TWO-COMPONENT EXTREME VALUE DISTRIBUTION FOR ASIA-PACIFIC STOCK INDEX RETURNS (2006). (42) RePEc:wsi:ijtafx:v:10:y:2007:i:03:p:505-516 KERNEL-BASED SEMI-LOG-OPTIMAL EMPIRICAL PORTFOLIO SELECTION STRATEGIES (2007). (43) RePEc:wsi:ijtafx:v:14:y:2011:i:03:p:353-368 OPTIMAL TRADE EXECUTION UNDER GEOMETRIC BROWNIAN MOTION IN THE ALMGREN AND CHRISS FRAMEWORK (2011). (44) RePEc:wsi:ijtafx:v:09:y:2006:i:03:p:415-453 PRICING AND HEDGING CONVERTIBLE BONDS: DELAYED CALLS AND UNCERTAIN VOLATILITY (2006). (45) RePEc:wsi:ijtafx:v:12:y:2009:i:01:p:83-112 CREDIT RISK MODELING WITH MISREPORTING AND INCOMPLETE INFORMATION (2009). (46) RePEc:wsi:ijtafx:v:10:y:2007:i:01:p:111-127 VARIANCE TERM STRUCTURE AND VIX FUTURES PRICING (2007). (47) RePEc:wsi:ijtafx:v:12:y:2009:i:07:p:901-924 FORWARD AND FUTURES PRICES WITH BUBBLES (2009). (48) RePEc:wsi:ijtafx:v:13:y:2010:i:06:p:839-865 FAST AND ACCURATE PRICING AND HEDGING OF LONG-DATED CMS SPREAD OPTIONS (2010). (49) RePEc:wsi:ijtafx:v:08:y:2005:i:08:p:1135-1155 THE IMPACT OF STOCK RETURNS VOLATILITY ON CREDIT DEFAULT SWAP RATES: A COPULA STUDY (2005). (50) RePEc:wsi:ijtafx:v:11:y:2008:i:05:p:415-445 SCENARIOS FOR PRICE DETERMINATION IN INCOMPLETE MARKETS (2008). Recent citations received in: | 2009 | 2008 | 2007 | 2006 Recent citations received in: 2009 (1) RePEc:arx:papers:0912.4404 Credit Calibration with Structural Models: The Lehman case and Equity Swaps under Counterparty Risk (2009). Quantitative Finance Papers (2) RePEc:kap:apfinm:v:16:y:2009:i:3:p:169-181 Counterparty Risk for Credit Default Swaps: Markov Chain Interacting Intensities Model with Stochastic Intensity (2009). Asia-Pacific Financial Markets (3) RePEc:mee:wpaper:0918 A Comparison of Reduced-Form Permit Price Models and their Empirical Performances (2009). Working Papers (4) RePEc:uts:rpaper:256 The Representation of American Options Prices under Stochastic Volatility and Jump-Diffusion Dynamics (2009). Research Paper Series Recent citations received in: 2008 (1) RePEc:cte:wbrepe:wb084912 Statistical Properties and Economic Implications of Jump-Diffusion Processes with Shot-Noise Effects (2008). Business Economics Working Papers Recent citations received in: 2007 Recent citations received in: 2006 (1) RePEc:hum:wpaper:sfb649dp2006-051 Regression methods in pricing American and Bermudan options using consumption processes (2006). SFB 649 Discussion Papers Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||