|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

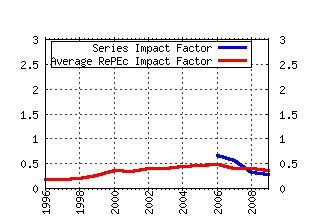

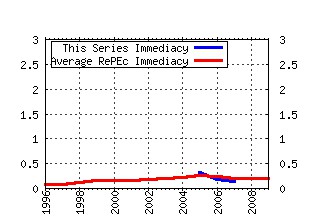

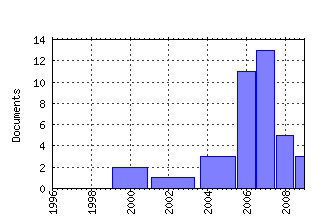

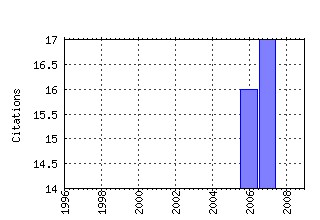

FiFo-CPE Discussion Papers - Finanzwissenschaftliche Diskussionsbeiträge Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:zbw:uoccpe:5142 Dokumentation FiFoSiM: Integriertes Steuer-Transfer-Mikrosimulations- und CGE-Modell (2005). (2) RePEc:zbw:uoccpe:5140 Die Evaluation von Steuerreformen durch Simulationsmodelle (2005). (3) RePEc:zbw:uoccpe:5152 Documentation FiFoSiM: integrated tax benefit microsimulation and CGE model (2006). (4) RePEc:zbw:uoccpe:7038 Documentation FiFoSiM: Integrated tax benefit microsimulation (2007). (5) RePEc:zbw:uoccpe:5147 Does tax simplification yield more equity and efficiency? An empirical analysis for Germany (2006). (6) RePEc:zbw:uoccpe:7222 Wie progressiv ist Deutschland? (2007). (7) RePEc:zbw:uoccpe:6152 Tax Enforcement and Tax Havens under Formula Apportionment (2007). (8) RePEc:zbw:uoccpe:7039 Grundeinkommen vs. Kombilohn: Beschäftigungs- und Finanzierungswirkungen und Unterschiede im Empfängerkreis (2007). (9) RePEc:zbw:uoccpe:5153 Measuring Richness and Poverty (2006). (10) RePEc:zbw:uoccpe:5151 Measuring distributional effects of fiscal reforms (2006). (11) RePEc:zbw:uoccpe:5143 Führt Steuervereinfachung zu einer gerechteren Einkommensverteilung? Eine empirische Analyse für Deutschland (2006). (12) RePEc:zbw:uoccpe:5148 Die Flat Tax: Wer gewinnt? Wer verliert? Eine empirische Analyse für Deutschland (2006). (13) RePEc:zbw:uoccpe:5144 Numerische Gleichgewichtsmodelle - Grundlagen und Anwendungsgebiete (2006). (14) RePEc:zbw:uoccpe:5150 Reformoptionen der Familienbesteuerung - Aufkommens-, Verteilungs- und Arbeitsangebotseffekte (2006). (15) repec:zbw:uoccpe:7221 (). (16) RePEc:zbw:uoccpe:5288 Wider die Arbeitslosigkeit der beruflich Geringqualifizierten: Entwurf eines Kombilohn-Verfahrens für den Niedriglohnsektor (2007). (17) RePEc:zbw:uoccpe:7220 Politicians outside earnings and electoral competition (2007). Recent citations received in: | 2009 | 2008 | 2007 | 2006 Recent citations received in: 2009 Recent citations received in: 2008 Recent citations received in: 2007 (1) RePEc:ces:ifosdt:v:60:y:2007:i:10:p:36-40 Beschäftigungs- und Finanzierungswirkungen des Bürgergeldkonzepts von Dieter Althaus (2007). Ifo Schnelldienst (2) RePEc:ces:ifosdt:v:60:y:2007:i:11:p:25-29 Der Kölner Kombilohn für den Niedriglohnsektor (2007). Ifo Schnelldienst Recent citations received in: 2006 (1) RePEc:zbw:uoccpe:5150 Reformoptionen der Familienbesteuerung - Aufkommens-, Verteilungs- und Arbeitsangebotseffekte (2006). FiFo-CPE Discussion Papers - Finanzwissenschaftliche Diskussionsbeiträge (2) RePEc:zbw:uoccpe:5152 Documentation FiFoSiM: integrated tax benefit microsimulation and CGE model (2006). FiFo-CPE Discussion Papers - Finanzwissenschaftliche Diskussionsbeiträge Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||